Copyright © Everyday Narrative 2024. All rights reserved.

Donald Trump, a figure synonymous with wealth and business acumen, recently faced a significant legal setback that pierced his billionaire image. A New York judge ordered Trump to pay $355 million in penalties for years of misrepresenting his wealth. This ruling, part of a sweeping civil fraud verdict, did not dismantle Trump’s real estate empire but imposed severe financial and operational penalties on his business dealings. Trump’s case serves as a reminder that legal accountability extends beyond the corridors of power to the luminaries of our time, including celebrities known for their contributions to arts, sports, and entertainment.

Trump’s legal woes stem from a lawsuit initiated by New York Attorney General Letitia James. The lawsuit accused Trump of inflating his wealth on financial statements to deceive banks and insurance companies. This act of fraud, according to Judge Arthur Engoron, was a calculated effort to boost Trump’s image and secure better terms in his business dealings. The repercussions of this ruling are vast, not only financially but also on Trump’s public persona as a successful businessman. It raises questions about the extent to which wealth and success are portrayed by public figures and the legal boundaries governing such representations.

This phenomenon of misrepresenting financial status, however, is not exclusive to Trump. The entertainment industry has seen its fair share of celebrities facing legal issues for financial misconduct. High-profile cases of tax evasion and fraud remind us that celebrities are not immune to the consequences of financial misrepresentation.

Celebrities Convicted of Financial Misconduct

Wesley Snipes faced a three-year prison sentence for failing to file tax returns, despite his success in Hollywood. His case highlighted the severe implications of tax evasion.

Lauryn Hill, celebrated for her musical talent, was sentenced to three months in prison for failing to file over three years of income taxes. Hill’s case underscores the importance of legal compliance, irrespective of one’s contributions to the arts.

Fat Joe’s rise in the music industry was marred by a four-month prison sentence for tax evasion, demonstrating that financial success must be matched with responsibility.

Ja Rule not only faced legal issues related to the Fyre Festival but was also sentenced to 28 months in prison for failing to file tax returns, further proving that celebrities are not exempt from financial scrutiny.

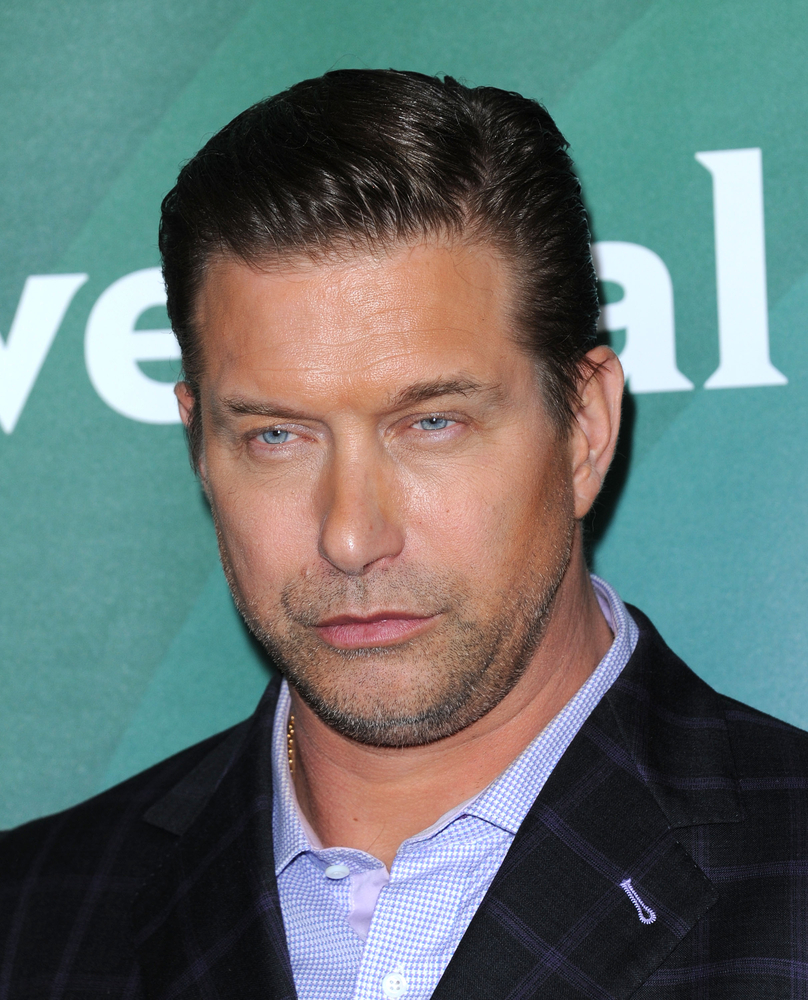

Stephen Baldwin was charged with failing to pay New York state taxes for three years. Although he managed to avoid jail time by settling his debts, Baldwin’s case illustrates the potential legal pitfalls of financial mismanagement.

Internationally, Yuan Bingyan, a Chinese actress, was fined almost 3 million yuan for tax evasion, highlighting the global nature of these legal challenges.

These instances serve as stark reminders of the consequences of financial misconduct. They underscore the importance of transparency and legal compliance in managing one’s finances, regardless of fame or social status. The cases of Trump and these celebrities elucidate a broader societal expectation for honesty in financial dealings, an expectation that transcends borders and professions.

The narrative of wealth and success is often glamorized, obscuring the legal and ethical obligations that accompany financial gains. Trump’s case, juxtaposed with those of various celebrities, serves as a cautionary tale of the pitfalls of financial misrepresentation. It is a call to adhere to legal standards and uphold integrity in financial declarations, ensuring that the allure of success does not eclipse the foundational principles of honesty and accountability.